Learn about Alabama USDA loan income limits now. Zero-down USDA Guaranteed Loans are the most popular rural development mortgage program in Alabama.

Alabama Usda Rd Mortgage Guide Usda Mortgage Source

Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

. Fixed interest rate based on current. USDA Loans have been designed to cater to the financial needs of an individual settled in Alabama. Homes for sale in Mobile County AL that are eligible for USDA Financing.

Ad Compare Top Mortgage Refinance Lenders. USDA Home loans from Primary Residential Mortgage is perfect for purchasing a new home or refinancing your existing home. Learn If You Qualify.

Call TODAY to speak with a USDA Home Loan. Ad Prequalify Online Today And See How Much You May Be Able To Borrow. 4121 Carmichael Road Suite 601.

The Alabama FSA State Committee oversees agency activities. Questions about Multifamily Housing Programs. The following areas are eligible for USDA financing.

Ad Use Our Comparison Site Find Out Which Home Lender Suits You The Best. To determine if a property is located in an eligible rural area click on one of the USDA Loan program links above and then select the Property Eligibility Program link. What is the approximate loan amount.

Comprehensive USDA-Only Home Online Index. About USDA Home Loans. This site provides information regarding the USDA loan program.

The loan is designed for residents in Alabama and across the US. Best for borrowers with weaker credit. As a part of USDA Rural Development our mission is to be a cost-effective service provider that strives to.

Effective July 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers. USDA provides homeownership opportunities to rural Americans and home renovation and repair programs. 100 Financing through the USDA Home Loan Program.

Up to 10 percent of grant funds may be applied toward operating expenses over the life of the Revolving. Welcome to the Alabama USDA homes website. Get Your VA Loan.

USDA also provides financing to elderly disabled or low-income rural residents in. Compare offers from our partners side by side and find the perfect lender for you. First the property in question must.

Benefits Of A USDA Loan - Low Rates No Down Payment No PMI. An Alabama USDA loan is a home loan that is backed by the United States Department of Agriculture. A home loan from the USDA loan program also known as the USDA Rural Development Guaranteed Housing Loan Program is a mortgage loan offered to rural property owners by the.

Get Instantly Matched With Your Ideal Home Lender. 720-850 680-719 660-679 640-659 620-639. NerdWallets Best USDA Mortgage Lenders of 2022.

Up to 300000 in grants may be requested to establish the Revolving Loan Funds. Trusted VA Loan Lender of 300000 Veterans Nationwide. It Only Takes Minutes to See What You Qualify For.

Best for digital convenience. Forty-five FSA County Service Center offices are located throughout Alabama to serve the needs of local farmers and ranchers. Effective July 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers.

2001 Park Place North Suite 650 Birmingham AL - 35203. That are low to. 1000 Urban Center Drive Suite 500 Birmingham AL - 35242.

US Department of Agriculture offers loan to those who belong to middle and lower. ZIP Code of the Alabama Property. Agricola Bay Minette Bayou La Batre Chatom Citronelle Foley Grand Bay Loxley Pascagoula Point Clear Robertsdale Semmes.

USDA Guaranteed Home Mortgage Loans are the most common type of USDA Loan in Alabama and allow for higher income li mits and 100 financing for home purchases. Welcome to the Rural Development Rural Housing Service Home Loans Web site. When you select a.

Ad USDA Homes Currently Available In Alabama. USDA home loan income limits may involve a couple of factors including maximum limits and debt to income ratios. Fixed interest rate based on current.

Fortunately for homebuyers rural America for purposes of the USDA Home Loan Program is 97 of the geographic landmass of the United States. What is your approximate credit score. Alabama USDA Home Loan eligibility will be determined by your financial history and the property youre choosing to buy.

Ad Easier Qualification And Low Rates With Government Backed Security. These loans are available for anyone with low to moderate income to purchase a. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Contact a Loan Specialist to Get a Personalized Quote. Also known as the Section 504 Home Repair program this provides loans to very-low-income homeowners to repair improve or modernize their homes or grants to elderly very-low-income. Save Time Money.

Ad Easier Qualification And Low Rates With Government Backed Security.

Usda Rural Home Loans Explained Nextadvisor With Time

291cloudscove New Kitchen Cabinets Convection Oven Open House

Home Lending Talladega Al Mortgage Companies How To Find Out Mortgage

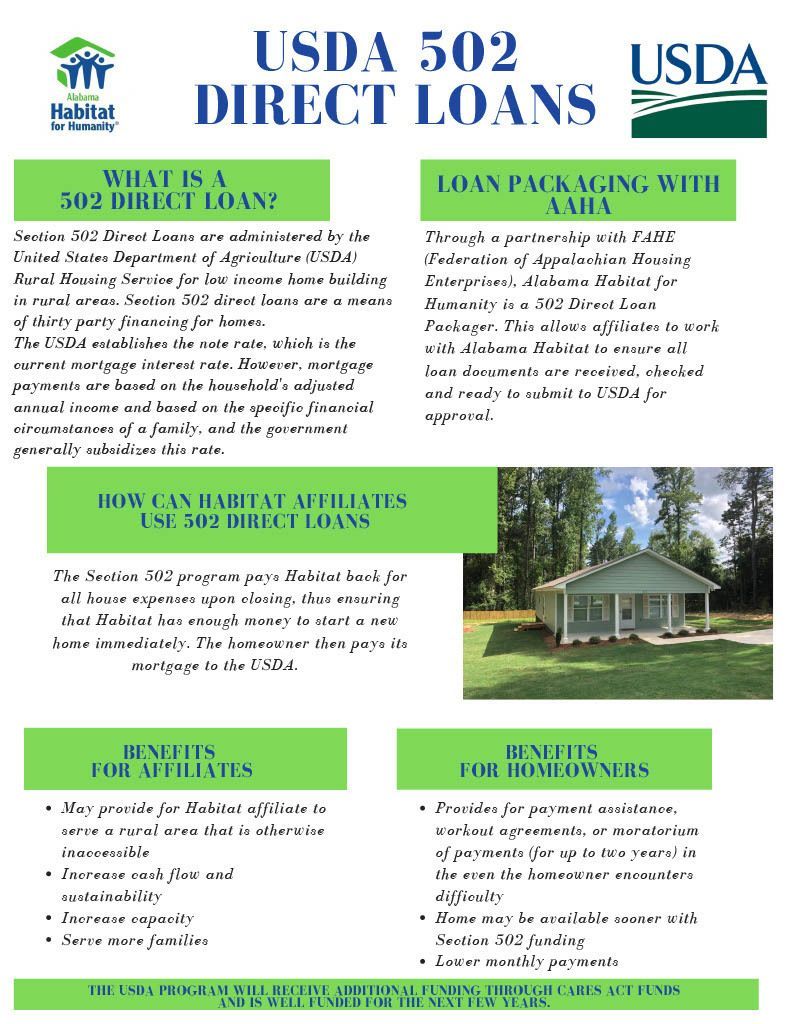

Usda Loan Program Programs Services What We Do Alabama Habitat For Humanity

Mortgage Preapproval Bad Credit Here Is Everything You Need To Know About How To Get A Mortgage Preapproval With Bad Credit And What To Expect As Low As 500 Cre Preapproved

Here Is The Ultimate List Of Why Getting A Home Inspection Is So Important Before Closing On Your New Home Home Inspection Home Termite Control

Credit Score Information For Kentucky Home Buyers Buying First Home Home Buying Checklist First Time Home Buyers

8 Tips For Landlords To Increase Rental Property Income Home Improvement Rental Property Home Buying Home And Family

0 comments

Post a Comment